What is Money?

Before we can understand Bitcoin — or why it matters — we need to go back to something much more basic: what is money?

It’s one of those things we all use but rarely think about. Money feels obvious until you really look at it. And when you do, you start to realize it’s not a fixed concept — it’s a tool, an agreement, and a system that has changed a lot over time.

Money Is a Technology

At its core, money is a technology for exchanging value. It helps us trade, store wealth, and measure things like cost and profit.

Economists usually define money by its three main functions:

- Medium of exchange – You can use it to buy and sell goods or services.

- Unit of account – It provides a standard measure of value across the economy.

- Store of value – You can save it and use it later without it losing too much value over time.

If something performs these functions well, it can be considered money. But how societies choose what to use as money has evolved drastically.

A Brief History of Money

Long before banks or Bitcoin, people used barter — trading goods directly. But barter has big limitations: you need a “coincidence of wants” (you must both want what the other has), and it’s not scalable.

That’s where commodity money came in — using scarce, recognizable, and desirable items as a common medium of exchange.

Some examples:

- Cowrie shells in Africa and Asia

- Salt in ancient Rome (the word ‘salary’ comes from the latin sal)

- Rai stones in Micronesia

- Gold and silver in Europe and the Middle East

Eventually, many civilizations converged on precious metals, especially gold and silver. These had durable, divisible, portable, and scarce properties — perfect for money.

From Metal to Paper

As trade expanded, carrying physical metal became inconvenient and risky. So societies invented representative money — paper notes backed by stored gold or silver.

This eventually led to fiat money: currency that’s not backed by any physical commodity but is accepted by government decree. The word “fiat” literally means “let it be done” in Latin — as in, “this has value because we say so.”

Most of today’s currencies (USD, EUR, CAD, etc.) are fiat currencies.

The Fiat Era

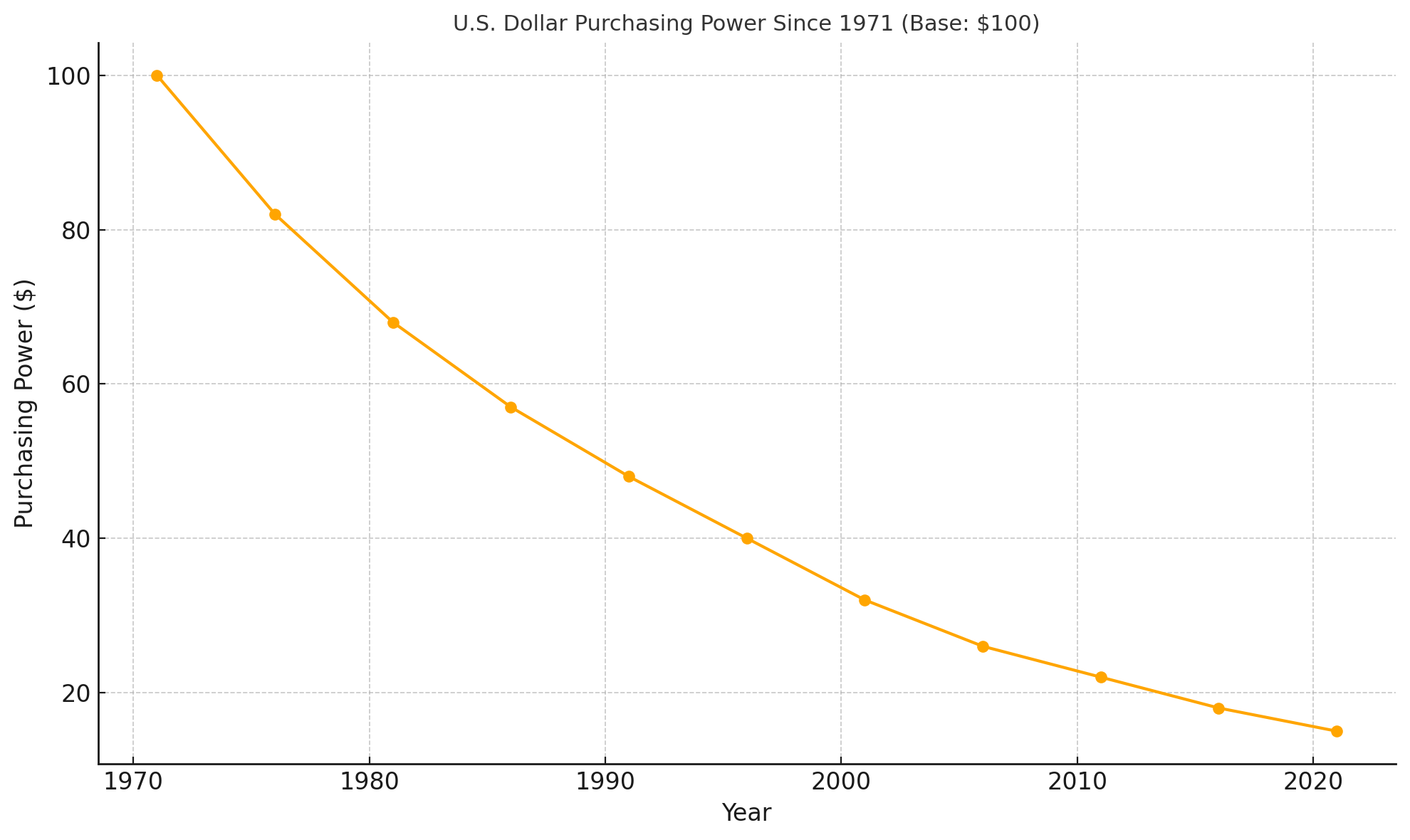

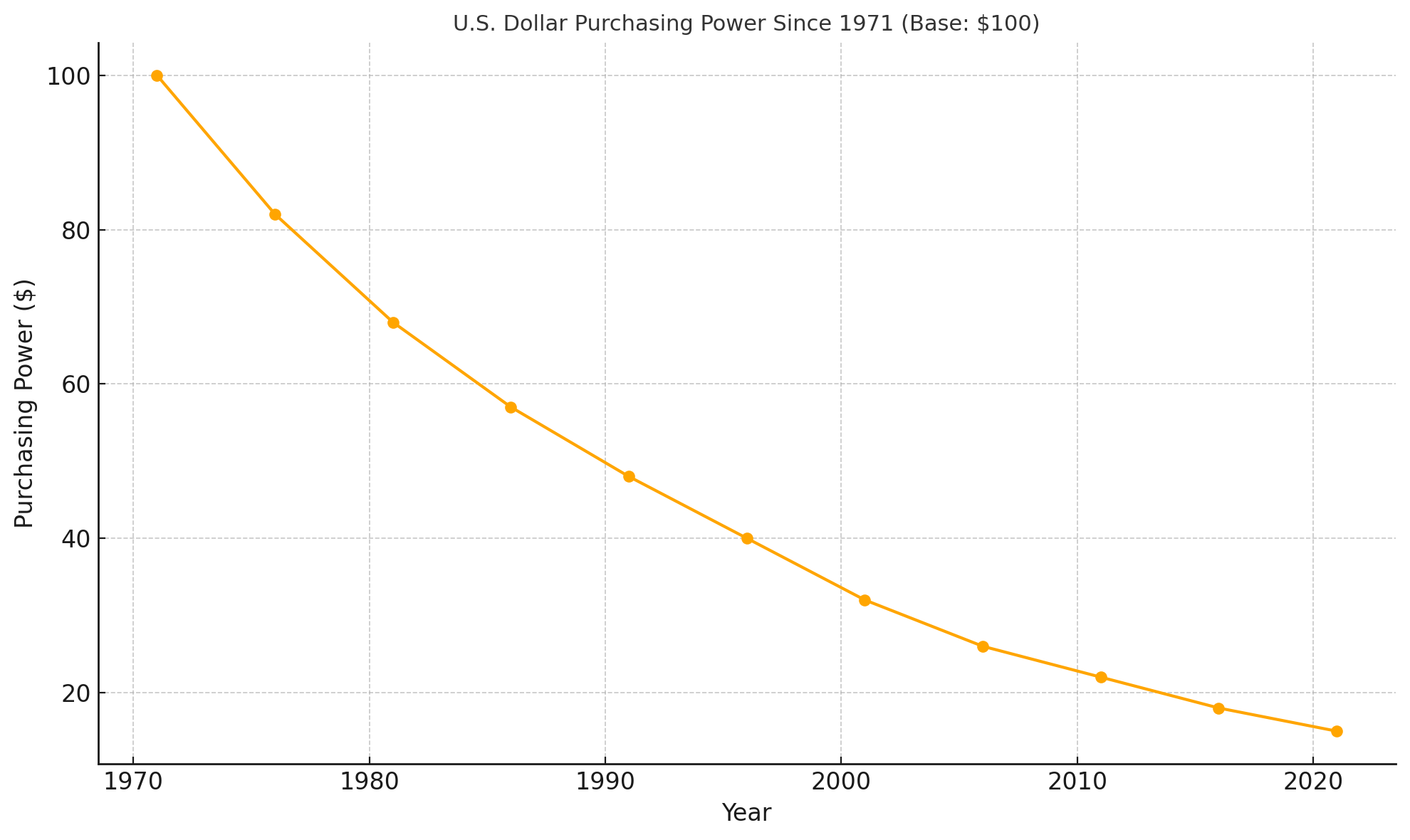

The modern fiat system began in 1971, when the U.S. fully abandoned the gold standard. From that point on, central banks could create new money without any tie to a scarce commodity.

This introduced flexibility — governments could respond to economic crises, fund spending, and stimulate growth. But it also opened the door to debasement through inflation.

Since 1971, the U.S. dollar has lost over 85% of its purchasing power.

Source: U.S. Bureau of Labor Statistics Inflation Calculator — https://www.bls.gov/data/inflation_calculator.htm

So What Makes Money Good?

Not all money is equal. Some forms hold their value better, are easier to trade, or are harder to manipulate.

Economists and historians often point to a few key traits of sound money:

- Scarcity – It can’t be easily created or counterfeited

- Divisibility – It can be split into smaller units

- Durability – It lasts over time

- Portability – It’s easy to carry and transfer

- Recognizability – People can easily identify and trust it

- Fungibility – Every unit is the same as every other unit

Gold performed these functions well, which is why it lasted as money for millennia. Fiat performs some well — but fails when it comes to scarcity and trust.

Why This Matters in the Bitcoin Era

Bitcoin forces us to revisit all of this.

- Is money something governments control?

- Should it be inflationary or fixed in supply?

- Can money exist purely as code?

Bitcoin doesn’t fit the traditional molds, but that’s kind of the point. It reopens the conversation about what money is — and whether the fiat system we inherited is actually the best we can do.

As we continue exploring Bitcoin and other digital assets, this question will come up again and again. And the more you understand about the history and purpose of money, the more Bitcoin starts to make sense.

Before we can understand Bitcoin — or why it matters — we need to go back to something much more basic: what is money?

It’s one of those things we all use but rarely think about. Money feels obvious until you really look at it. And when you do, you start to realize it’s not a fixed concept — it’s a tool, an agreement, and a system that has changed a lot over time.

Money Is a Technology

At its core, money is a technology for exchanging value. It helps us trade, store wealth, and measure things like cost and profit.

Economists usually define money by its three main functions:

- Medium of exchange – You can use it to buy and sell goods or services.

- Unit of account – It provides a standard measure of value across the economy.

- Store of value – You can save it and use it later without it losing too much value over time.

If something performs these functions well, it can be considered money. But how societies choose what to use as money has evolved drastically.

A Brief History of Money

Long before banks or Bitcoin, people used barter — trading goods directly. But barter has big limitations: you need a “coincidence of wants” (you must both want what the other has), and it’s not scalable.

That’s where commodity money came in — using scarce, recognizable, and desirable items as a common medium of exchange.

Some examples:

- Cowrie shells in Africa and Asia

- Salt in ancient Rome (the word ‘salary’ comes from the latin sal)

- Rai stones in Micronesia

- Gold and silver in Europe and the Middle East

Eventually, many civilizations converged on precious metals, especially gold and silver. These had durable, divisible, portable, and scarce properties — perfect for money.

From Metal to Paper

As trade expanded, carrying physical metal became inconvenient and risky. So societies invented representative money — paper notes backed by stored gold or silver.

This eventually led to fiat money: currency that’s not backed by any physical commodity but is accepted by government decree. The word “fiat” literally means “let it be done” in Latin — as in, “this has value because we say so.”

Most of today’s currencies (USD, EUR, CAD, etc.) are fiat currencies.

The Fiat Era

The modern fiat system began in 1971, when the U.S. fully abandoned the gold standard. From that point on, central banks could create new money without any tie to a scarce commodity.

This introduced flexibility — governments could respond to economic crises, fund spending, and stimulate growth. But it also opened the door to debasement through inflation.

Since 1971, the U.S. dollar has lost over 85% of its purchasing power.

Source: U.S. Bureau of Labor Statistics Inflation Calculator — https://www.bls.gov/data/inflation_calculator.htm

So What Makes Money Good?

Not all money is equal. Some forms hold their value better, are easier to trade, or are harder to manipulate.

Economists and historians often point to a few key traits of sound money:

- Scarcity – It can’t be easily created or counterfeited

- Divisibility – It can be split into smaller units

- Durability – It lasts over time

- Portability – It’s easy to carry and transfer

- Recognizability – People can easily identify and trust it

- Fungibility – Every unit is the same as every other unit

Gold performed these functions well, which is why it lasted as money for millennia. Fiat performs some well — but fails when it comes to scarcity and trust.

Why This Matters in the Bitcoin Era

Bitcoin forces us to revisit all of this.

- Is money something governments control?

- Should it be inflationary or fixed in supply?

- Can money exist purely as code?

Bitcoin doesn’t fit the traditional molds, but that’s kind of the point. It reopens the conversation about what money is — and whether the fiat system we inherited is actually the best we can do.

As we continue exploring Bitcoin and other digital assets, this question will come up again and again. And the more you understand about the history and purpose of money, the more Bitcoin starts to make sense.