The Strategic Bitcoin Reserve: Why the U.S. Is Buying Bitcoin

On March 6th 2025, the United States officially announced the creation of a Strategic Bitcoin Reserve. This move represents a major shift in how governments view Bitcoin — not as a speculative asset or technological curiosity, but as a strategic monetary tool.

This post explains what the Strategic Bitcoin Reserve is, why the U.S. is establishing it, how it will be funded, and what this means for the future of Bitcoin and global finance.

What Is a Strategic Bitcoin Reserve?

Traditionally, governments maintain strategic reserves of assets like gold, oil, or foreign currencies to protect national interests and provide economic stability. These reserves serve as a form of financial insurance — a way to respond to crises, secure monetary credibility, or influence markets.

The Strategic Bitcoin Reserve follows this same logic, but with a 21st-century twist: it treats Bitcoin as a monetary reserve asset worthy of national stockpiling.

Timeline of Events

Here’s how we got here:

July 2024 — Senator Cynthia Lummis introduces the BITCOIN Act, proposing a federal Bitcoin acquisition program of up to 200,000 BTC per year for five years.

August 2024 — Early drafts of the BITCOIN Act reveal the proposed funding mechanism: revaluing the Federal Reserve’s gold certificates to reflect market prices. This revaluation would unlock accounting gains to fund Bitcoin purchases without increasing taxes or national debt.

March 2025 — President Trump signs an executive order to create the Strategic Bitcoin Reserve and a broader U.S. Digital Asset Stockpile, signaling national-level commitment to digital asset infrastructure.

Which Assets Will Be Included?

While the focus is on Bitcoin, the digital asset reserve will also include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Solana (SOL)

- Cardano (ADA)

This broader inclusion suggests the U.S. is not only treating Bitcoin as a store of value but also exploring the infrastructure and use cases behind other blockchains.

How Will the U.S. Pay for This?

Interestingly, the funding mechanism avoids new taxes or money printing.

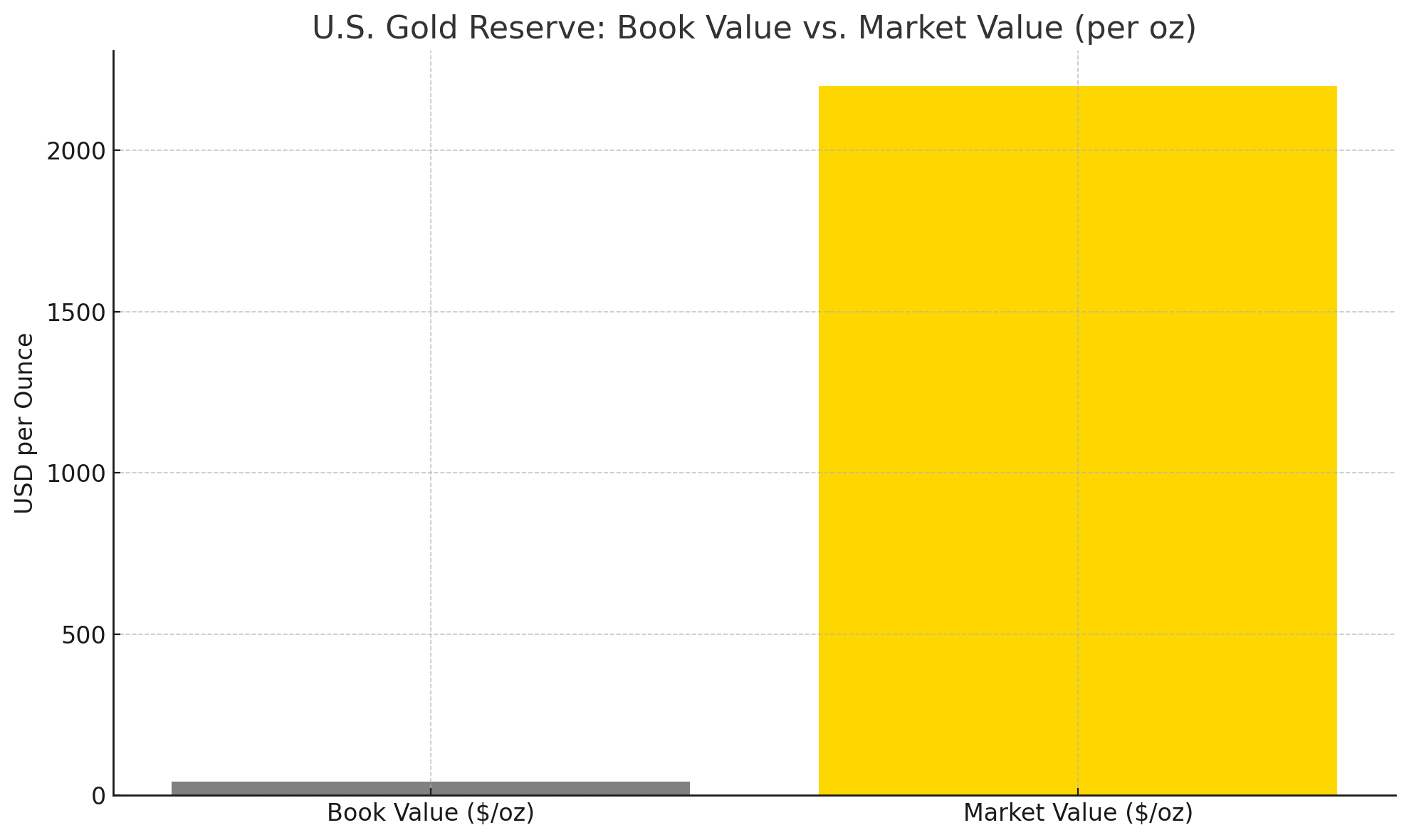

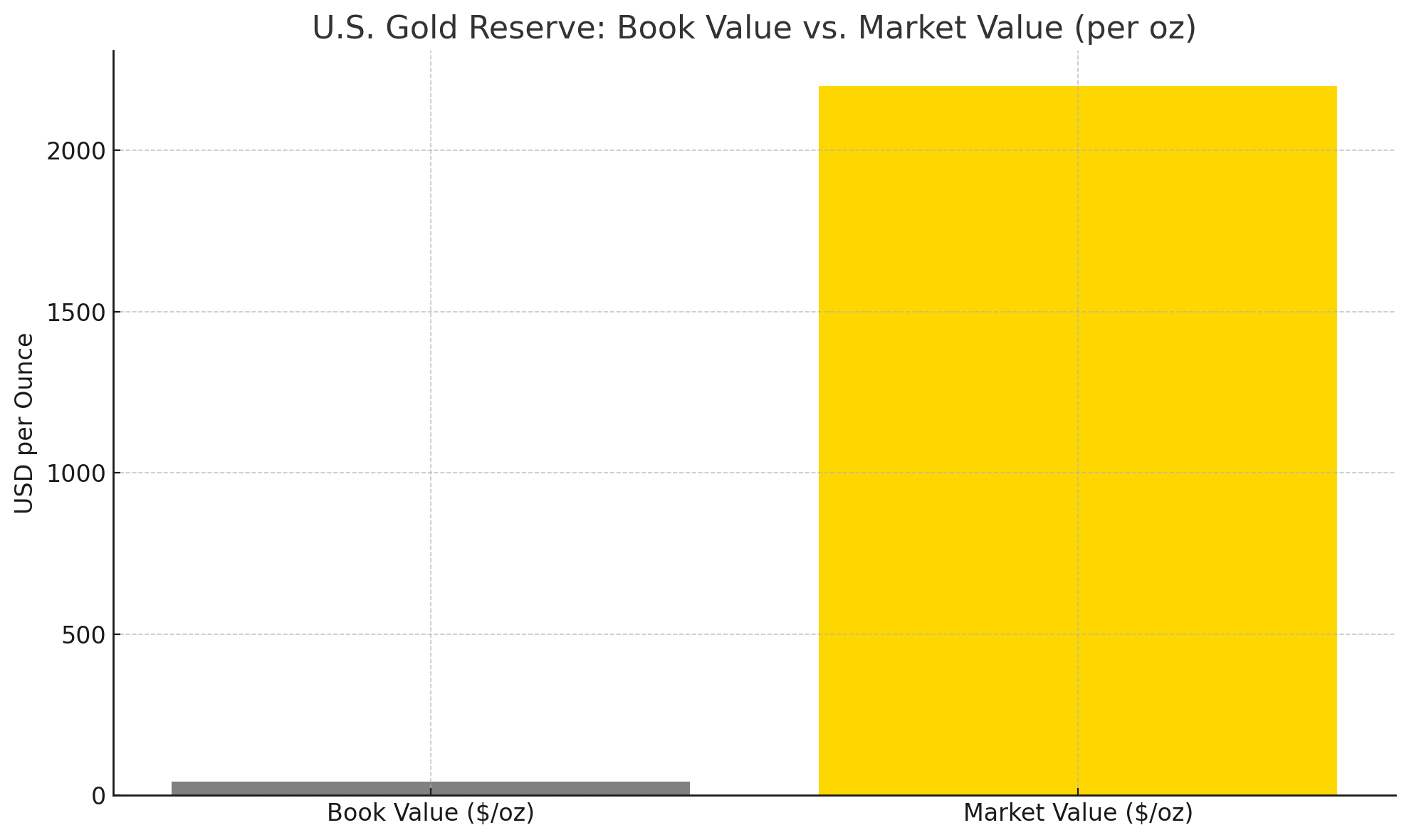

Instead, the government plans to revalue its existing gold reserves. The gold held by the Federal Reserve is currently valued on the books at ~$42/oz — far below its market value (which has been over $2,000/oz). By adjusting this book value closer to market price, the government can “unlock” accounting gains that can be used to acquire Bitcoin.

Sources: https://fiscal.treasury.gov/reports-statements/treasury-direct.html, https://www.kitco.com/

This revaluation does not involve selling gold or changing monetary policy — it’s a creative way to fund Bitcoin acquisition using existing national wealth.

Why Is the U.S. Doing This?

There are several possible motivations:

1. Monetary Diversification

Adding Bitcoin to the U.S. reserve portfolio hedges against the long-term risks of dollar debasement and global de-dollarization.

2. Strategic Positioning

Bitcoin adoption is accelerating globally. Holding Bitcoin ensures the U.S. isn’t left behind in a future where decentralized digital assets play a larger role in the financial system.

3. Geopolitical Leverage

As other countries explore central bank digital currencies (CBDCs) and accumulate gold or digital assets, Bitcoin gives the U.S. another tool to compete economically — especially if other nations begin holding BTC as well.

Market Impact

Immediately after the announcement, Bitcoin and the other listed assets saw a significant price rally.

Source: Aggregate data from CoinGecko

This shows how much market sentiment is influenced by institutional and governmental involvement. It also demonstrates growing confidence in Bitcoin as a legitimate, strategic asset.

What Happens Next?

As of April 2025, the Strategic Bitcoin Reserve is in early implementation:

- Wallet infrastructure and cold storage custody are being developed.

- Acquisition timelines and procurement methods (e.g., over-the-counter purchases) are being finalized.

- Collaboration with U.S.-based crypto infrastructure firms is underway.

This move could trigger a domino effect — other nations may begin considering or accelerating their own crypto reserve strategies.

This is a historic moment for Bitcoin.

For years, Bitcoin advocates argued that Bitcoin is sound money, a digital form of gold. That idea just received one of the strongest validations yet — from the world’s largest economy.

If Bitcoin was once seen as a tool for the fringe, it is now being treated as a core part of a national financial strategy.

The implications are enormous.

Sources:

https://www.coindesk.com/policy/2024/07/30/us-strategic-bitcoin-reserve

https://www.whitehouse.gov/fact-sheets/2025/03/strategic-bitcoin-reserve

https://www.businessinsider.com/crypto-trump-strategic-reserve

On March 6th 2025, the United States officially announced the creation of a Strategic Bitcoin Reserve. This move represents a major shift in how governments view Bitcoin — not as a speculative asset or technological curiosity, but as a strategic monetary tool.

This post explains what the Strategic Bitcoin Reserve is, why the U.S. is establishing it, how it will be funded, and what this means for the future of Bitcoin and global finance.

What Is a Strategic Bitcoin Reserve?

Traditionally, governments maintain strategic reserves of assets like gold, oil, or foreign currencies to protect national interests and provide economic stability. These reserves serve as a form of financial insurance — a way to respond to crises, secure monetary credibility, or influence markets.

The Strategic Bitcoin Reserve follows this same logic, but with a 21st-century twist: it treats Bitcoin as a monetary reserve asset worthy of national stockpiling.

Timeline of Events

Here’s how we got here:

July 2024 — Senator Cynthia Lummis introduces the BITCOIN Act, proposing a federal Bitcoin acquisition program of up to 200,000 BTC per year for five years.

August 2024 — Early drafts of the BITCOIN Act reveal the proposed funding mechanism: revaluing the Federal Reserve’s gold certificates to reflect market prices. This revaluation would unlock accounting gains to fund Bitcoin purchases without increasing taxes or national debt.

March 2025 — President Trump signs an executive order to create the Strategic Bitcoin Reserve and a broader U.S. Digital Asset Stockpile, signaling national-level commitment to digital asset infrastructure.

Which Assets Will Be Included?

While the focus is on Bitcoin, the digital asset reserve will also include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Solana (SOL)

- Cardano (ADA)

This broader inclusion suggests the U.S. is not only treating Bitcoin as a store of value but also exploring the infrastructure and use cases behind other blockchains.

How Will the U.S. Pay for This?

Interestingly, the funding mechanism avoids new taxes or money printing.

Instead, the government plans to revalue its existing gold reserves. The gold held by the Federal Reserve is currently valued on the books at ~$42/oz — far below its market value (which has been over $2,000/oz). By adjusting this book value closer to market price, the government can “unlock” accounting gains that can be used to acquire Bitcoin.

Sources: https://fiscal.treasury.gov/reports-statements/treasury-direct.html, https://www.kitco.com/

This revaluation does not involve selling gold or changing monetary policy — it’s a creative way to fund Bitcoin acquisition using existing national wealth.

Why Is the U.S. Doing This?

There are several possible motivations:

1. Monetary Diversification

Adding Bitcoin to the U.S. reserve portfolio hedges against the long-term risks of dollar debasement and global de-dollarization.

2. Strategic Positioning

Bitcoin adoption is accelerating globally. Holding Bitcoin ensures the U.S. isn’t left behind in a future where decentralized digital assets play a larger role in the financial system.

3. Geopolitical Leverage

As other countries explore central bank digital currencies (CBDCs) and accumulate gold or digital assets, Bitcoin gives the U.S. another tool to compete economically — especially if other nations begin holding BTC as well.

Market Impact

Immediately after the announcement, Bitcoin and the other listed assets saw a significant price rally.

Source: Aggregate data from CoinGecko

This shows how much market sentiment is influenced by institutional and governmental involvement. It also demonstrates growing confidence in Bitcoin as a legitimate, strategic asset.

What Happens Next?

As of April 2025, the Strategic Bitcoin Reserve is in early implementation:

- Wallet infrastructure and cold storage custody are being developed.

- Acquisition timelines and procurement methods (e.g., over-the-counter purchases) are being finalized.

- Collaboration with U.S.-based crypto infrastructure firms is underway.

This move could trigger a domino effect — other nations may begin considering or accelerating their own crypto reserve strategies.

This is a historic moment for Bitcoin.

For years, Bitcoin advocates argued that Bitcoin is sound money, a digital form of gold. That idea just received one of the strongest validations yet — from the world’s largest economy.

If Bitcoin was once seen as a tool for the fringe, it is now being treated as a core part of a national financial strategy.

The implications are enormous.

Sources:

https://www.coindesk.com/policy/2024/07/30/us-strategic-bitcoin-reserve

https://www.whitehouse.gov/fact-sheets/2025/03/strategic-bitcoin-reserve

https://www.businessinsider.com/crypto-trump-strategic-reserve